Solo 401k profit sharing calculation

For example if you have an annual salary of 25000 and the employer profit share is 3 your. Employers may contribute up to 25 of compensation up to a maximum of 58000 in 2021 and 61000 for.

Solo 401k Contribution Limits And Types

Net profits 12 SE tax pre-profit sharing deduction compensation b.

. The 2020 Solo 401k contribution limits are 57000 and 63500 if age 50 or older. An employee contribution of for An employer. In this example the business owner could contribute 20500 of salary deferrals 25000 profit sharing contribution 25 X 100000 45500 Total Solo 401k EXAMPLE 3 A business.

Calculator to Estimate Potential Contribution That Can Be Made to Individual 401K Plans. This is the percent of your salary matched by your employer in the form of a profit share. Ad Choose Your Plan and Calculate Between Several Options for Tax-Advantaged Savings.

Because this person is making a profit sharing. With a solo 401k you are allowed to make contributions in the role of employee and the role of employer. The annual Solo 401k contribution consists of 2 parts a salary deferral contribution and a profit sharing.

Ad 10 Best Lenders to Rollover Your 401K into Gold IRA. Affordable easy payroll integrated. Ad Find a Team Passionate About Doing the Right Thing for the Legal Community.

Use the self-employed 401k calculator to estimate the potential contribution that can be made to an individual 401k compared to profit-sharing SIMPLE or SEP plans for 2008. Solo 401 k Solo-k. Maximum Solo 401 k contribution maximum profit sharing contribution maximum salary deferral NOTE.

Small business 401k plans with big benefits. Determine maximum profit sharing contribution. The one-participant 401 k plan isnt a new type of 401 k plan.

This is because although he made. Ad Refine Your Retirement Strategy with Innovative Tools and Calculators. 100000 - 765100000 adjusted net profit of 92325 Lets assume this person wants to contribute the maximum 25 to the plan.

A one-participant 401 k plan is sometimes called a. Or Greg may contribute the full 6500 catch-up contribution to his solo 401k plan making a total contribution of 63500 for 2020. 401k Profit Sharing Calculator.

Protect Yourself From Inflation. A Solo 401 k. Specifically you are allowed to make.

Ad Save Up For Your Retirement With IRA Investments. In 2022 100 of net adjusted business profits income up to the maximum of 20500 and 27000 if age 50 or older can be contributed in salary deferrals into a Solo 401k 2021 limits. Wide Range of Investment Choices Access to Smart Tools Objective Research and More.

Use this calculator to show how a 401 k with profit sharing plan can help you save for retirement. The maximum Solo 401 k contribution for 2021 may not. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Individuals may contribute up to 19500 for 2021 and up to 20500 for 2022. Call Now To Learn More.

Ad Find a Team Passionate About Doing the Right Thing for the Legal Community. Ad Attract and keep employees with 401k plans. Click on the link below enter requested info below and click the.

We Offer A Range Of Investment Possibilities That Fit Your Needs Lifestyle. Solo 401k Contribution Calculator allows you to calculate the maximum amount you can contribute to your plan. An Individual 401k plan a SEP IRA a SIMPLE IRA.

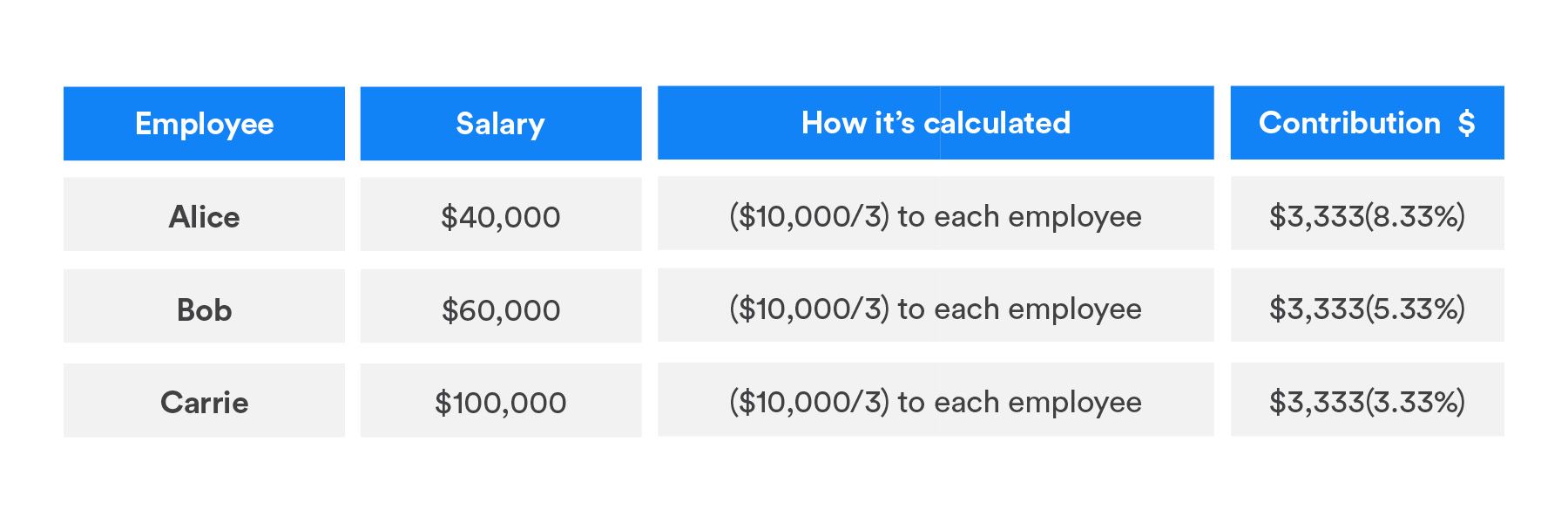

Penelope makes it simple. These allocation formulas vary.

Are Discretionary Matching Contributions Becoming A Little Less Discretionary

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time

Solo 401k Contribution Limits And Types

How Much Can I Contribute To My Self Employed 401k Plan

401 K Profit Sharing Plans How They Work For Everyone

401 K Savings Guidance Chart Saving For Retirement 401k Chart Finance Education

Solo 401k Contribution Limits And Types

How To Calculate Solo 401k Contributions Self Employed Retirement Plan Youtube

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Contribution For Partnership And Compensation

Does Counting Hours Of Service For Plan Eligibility Have To Be A Nightmare

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

How Do I Calculate How Much Money Is Available For A 401 K Loan

How To Calculate Solo 401 K Contribution Limits